Bookkeeping

5 8: Common-Size Statements Business LibreTexts

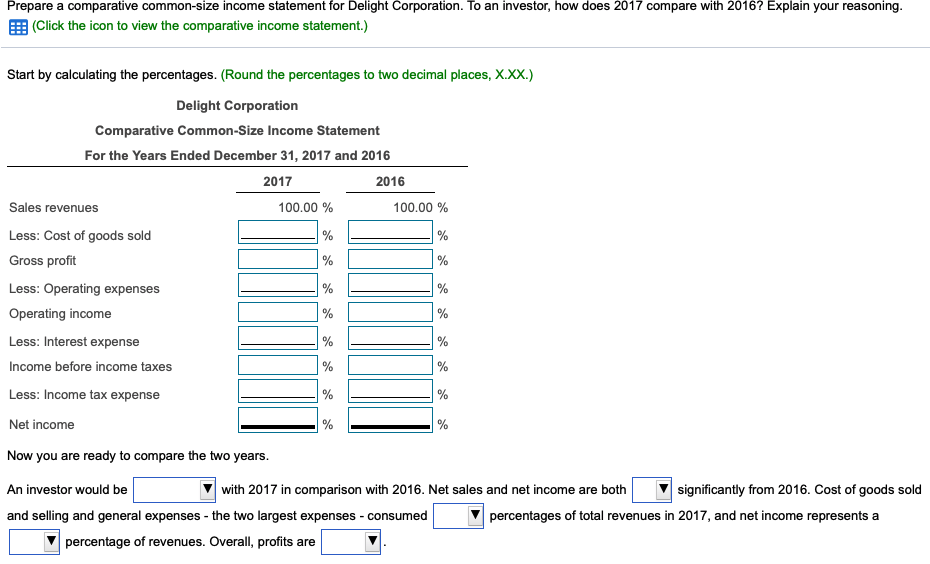

This common-size income statement shows an R&D expense that averages close to 1.5% of revenues. All three of the primary financial statements can be put into a common-size format. Financial statements in dollar amounts can easily be converted to common-size statements using a spreadsheet. Let’s understand how to prepare comparative income statement with the help of some suitable examples. One of the popular techniques of Comparative Income Statement shows the change in amount both in absolute and percentage terms over some time.

When to Use Common Size Financial Statements

Although her investing activities now represent a significant use of cash, her need to use cash in financing activities—debt repayment—is so much less that her net cash flow has increased substantially. The cash that used to have to go toward supporting debt obligations now goes toward building an asset base, some of which (the 401(k)) may provide income in the future. In fact, her debt repayments don’t leave her with much free cash flow; that is, cash flow not used up on living expenses or debts. Below, we delve into the key differences between comparative and common size financial statements. Management’s analysis of financial statements primarily relates to parts of the company. Using this approach, management can plan, evaluate, and control operations within the company.

What Is a Common Size Balance Sheet?

- Likewise, we can find the growth rates of other line items using a similar formula.

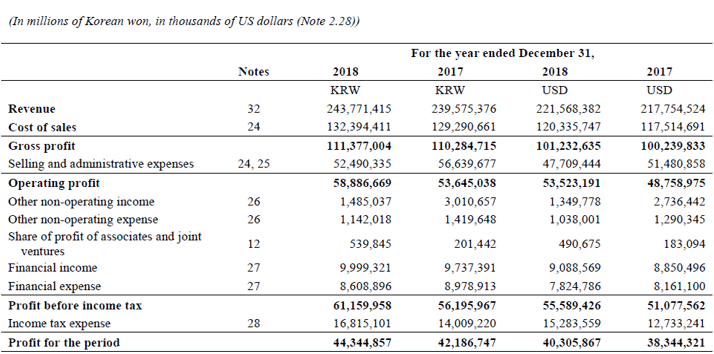

- COGS divided by $100,000 is 50%, operating profit divided by $100,000 is 40%, and net income divided by $100,000 is 32%.

- On the balance sheet, each item is listed as a percentage of total assets, showing the relative significance and diversification of assets, and highlighting the use of debt as financing for the assets.

- In other words, net revenue will be the overall base figure on your common size analysis formula.

- Using this approach, management can plan, evaluate, and control operations within the company.

On the debt and equity side of the balance sheet, however, there were a few percentage changes worth noting. In the prior year, the balance sheet reflected 55 percent debt and 45 percent equity. In the current year, that balance shifted to 60 percent debt and 40 percent equity. The firm did issue additional stock and showed an increase in retained earnings, both totaling a $10,000 increase in equity. However, the equity increase was much smaller than the total increase in liabilities of $40,000. The remainder of that increase is seen in the 5 percent increase in current liabilities.

Purpose and Benefits of Using Comparative Financial Statements

Any ratio shows the relative size of the two items compared, just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. The percentages on the common-size statements are ratios, although they only compare items within a financial statement. For example, you can see how much debt you have just by looking at your total liabilities, but how can you tell if you can afford the debt you have? That depends on the income you have to meet your interest and repayment obligations, or the assets you could use (sell) to meet those obligations.

You can then conclude whether the debt level is too high, if excess cash is being retained on the balance sheet, or if inventories are growing too high. The income from selling the products or services will show up in operating profit. If it is declining, which is in the case of XYZ, Inc., there is less money for the shareholders and for any other goals that the firm’s management wants to achieve. It is also watched closely by lenders (e.g., banks) when assessing a company’s credit risk. Such Analysis helps in comparing the performance with another business, which can analyze how companies react to market conditions affecting the companies belonging to the same Industry.

What a Common Size Income Statement Analysis Does

They can also look at the percentage for each expense over time to see if they are spending more or less on certain areas of the business, such as research and development. On the balance sheet, analysts commonly look to see the percentage of debt and equity to determine capital structure. They comparative common size income statement can also quickly see the percentage of current versus noncurrent assets and liabilities. While most firms do not report their statements in common size format, it is beneficial for analysts to do so to compare two or more companies of differing size or different sectors of the economy.

A comparative income statement shows the multiple accounting period outcomes in separate columns. This format enables the reader to compare the numerous historical period’s effects, looking at how a business did over the period. A Comparative Income Statement shows the operating results for several accounting periods. It helps the reader of such a statement to compare the results over the different periods for better understanding and detailed analysis of variation of line-wise items of Income Statement. Common-size statements put the details of the financial statements in clear relief relative to a common factor for each statement, but each financial statement is also related to the others. Each is a piece of a larger picture, and as important as it is to see each piece, it is also important to see that larger picture.

The key benefit of a common-size analysis is that it allows for a vertical analysis by line item over a single period, such as quarterly or annually. It also allows you to view a horizontal perspective over a period such as the three years that were analyzed in our example. Comparing the relative results of the common-size statements provides an even deeper view of the relative changes in Alice’s situation (Figure 3.25, Figure 3.26, and Figure 3.27).

This format standardizes financial data, making it easier to compare companies of different sizes and industries. This type of analysis is used to analyze a company’s financial statements to identify patterns and trend lines, and to compare a company against competitors. When figures are expressed as a percentage of a whole, analysts can assess how each part contributes relative to another.

Expressing the figures on the income statement and balance sheet as percentages rather than raw dollar figures allows for comparison to other companies regardless of size differences. Each line item on a balance sheet, statement of income, or statement of cash flows is divided by revenue or sales. You might be able to find them on the websites of companies that specialize in financial analysis. Generally speaking, a common-size financial statement is a type of analysis of an income statement that expresses each line of the statement as a percentage of sales. The next point of the analysis is the company’s non-operating expenses, such as interest expense. The income statement does not tell us how much debt the company has, but since depreciation increased, it is reasonable to assume that the firm bought new fixed assets and used debt financing to do it.