Bookkeeping

Debit vs Credit What’s the Difference? Example Chart Explanation

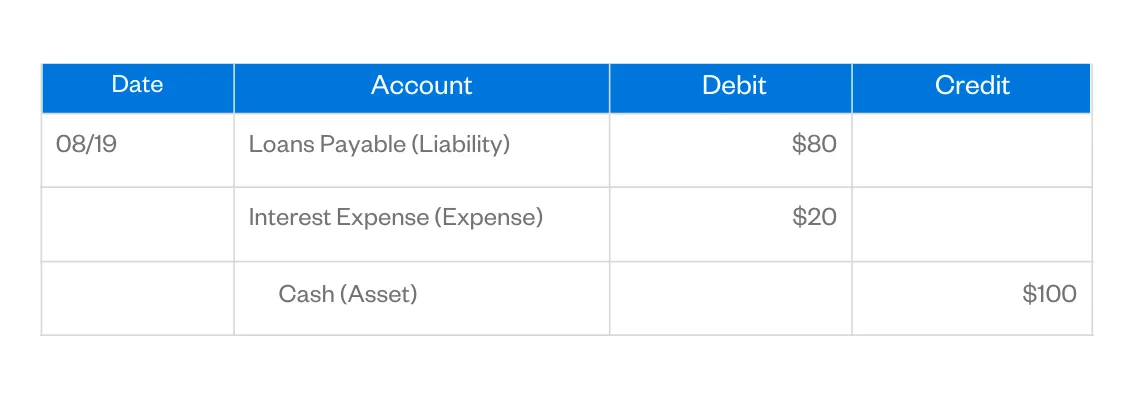

While there are two debit entries and only one credit entry, the total dollar amount of debits and credits are equal, which means the transaction is in balance. Remember that owners’ equity has a normal balance of a credit. Therefore, income statement accounts that increase owners’ equity have credit normal balances, and accounts that decrease owners’ equity have debit normal balances. Debits are primarily used to increase expense accounts, reflecting the cost being used or paid.

Debits and Credits in Transactions

For example, when a customer makes a purchase, you credit your revenue account, which increases your total income. Spending cash, selling inventory, or customers paying down their debts are all examples of credits since these resources are leaving your company. The owner’s equity and shareholders’ equity accounts are the common interest in your business, represented by common stock, additional paid-in capital, and retained earnings. The double-entry system provides a more comprehensive understanding of your business transactions.

Use the double-entry bookkeeping system

Because your “bank loan bucket” measures not how much you have, but how much you owe. The more you owe, the larger the value in the bank loan bucket is going to be. Your “furniture” bucket, which represents the total value of all the furniture your company owns, also changes. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Debits decrease your equity, usually when you pay out dividends, experience losses, or withdraw funds from the business.

Debits and Credits (Explanation Part

Others use the word to signify a net amount, such as income from operations (revenues minus expenses in the company’s main operating activities). Still others use it when referring to nonoperating revenues, such as interest income. Liabilities often have the word “payable” in the account title. Liabilities also include amounts received in advance for a future sale or for a future service to be performed. The 500 year-old accounting system where every transaction is recorded into at least two accounts. After you have identified the two or more accounts involved in a business transaction, you must debit at least one account and credit at least one account.

- He is the sole author of all the materials on AccountingCoach.com.

- First, your cash account would go up by $1,000, because you now have $1,000 more from mom.

- An expense account is a record of all the money that a company has spent on operating costs.

- In accounting, debits and credits are used to record financial transactions.

Income or Revenue Account

Liability and revenue accounts are increased with a credit entry, with some exceptions. Debits generally represent actions that decrease liabilities, such as paying off a loan. On the other hand, credits signify activities that increase liabilities, like borrowing money. For example, borrowing $5,000 from the bank would involve debiting cash (the asset increases) and crediting accounts payable (the liability increases). Assets and expense accounts are increased with a debit and decreased with a credit.

Debits VS Credits: A Simple, Visual Guide

Ultimately, this system helps keep your books balanced and helps make sure nothing slips through the cracks. Can’t figure out whether to use a debit or credit for a particular account? The equation is comprised of assets (debits) which are offset by liabilities and equity (credits). You’ll know if you need to use a debit or credit because the equation must stay in balance. Your bookkeeper or accountant should know the types of accounts your business uses and how to calculate each of their debits and credits. Today, most bookkeepers and business owners use accounting software to record debits and credits.

Apple Inc is a compelling example of an organization where correct credit and debit entries have contributed to a sound financial standing. Over the years, Apple has strategically managed its financials, effectively leveraging credit and debit transactions. Mike Dion brings a wealth the standard deduction of knowledge in business finance to his writing, drawing on his background as a Senior FP&A Leader. Over more than a decade of finance experience, Mike has added tens of millions of dollars to businesses from the Fortune 100 to startups and from Entertainment to Telecom.

This represents the wages or salaries owed to employees that have been earned but not yet paid. For example, a business accrued $1,000 in wages for the current pay period. This represents the cumulative profits earned by the business that has not been distributed to shareholders as dividends. On February 28th the company paid $5,000 worth of wages to employees. On January 3rd, 2021, the owner of the company XYZ invests $5,000 in cash for capital stock. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease.